Backtesting: This permits traders to take a look at how a specific technique might have carried out to predict much more precisely how it's going to do Down the road. Remember that earlier overall performance isn't constantly indicative of potential effects.

Start off compact. Give attention to a few stocks instead of donning yourself thin. Heading all out will complicate your trading approach and can imply big losses.

If a trader executes more than three working day trades within just 5 small business days and doesn't satisfy the minimum amount equity requirement, their account can be restricted from working day trading until eventually the minimum fairness requirement is satisfied. It is important to notice that the PDT rule only applies to margin accounts, not money accounts.

There’s an intense sensation to overcome the loss as rapidly as possible. And to do so, You begin using random trades that may cause far more harm than superior.

Performance cookies and Net beacons permit us to count visits and targeted traffic sources so we are able to measure and increase website functionality. They help us to grasp which internet pages are the most and minimum well-liked and find out how guests navigate about our Web-site.

1 crucial difference lies in the opportunity for leverage and risk. Working day traders normally use margin accounts to amplify their purchasing energy, which might magnify both of those gains and losses. Possibilities traders, In the meantime, can reach leverage with the mother nature of possibilities contracts them selves.

All facts and facts on the website is for reference only and no historical facts shall be regarded as the basis for judging foreseeable future traits.

Seek out support: It is vital to have a support procedure in place to help take care of the psychological issues of day trading. This could certainly contain conversing with a mentor or joining a trading Neighborhood.

Bullion bars need to be manufactured by a national federal government mint or COMEX or NYMEX-approved refiner, need trading to satisfy fineness necessities, and possess the ISO9001 certification to be IRA-accepted.

A sample working day trader (PDT) is a classification given by the U.S. Securities and Trade Fee (SEC) to traders who execute four or even more "day trades" inside of five business enterprise days utilizing a margin account. A "day trade" is defined as purchasing and selling the exact same protection on the identical working day.

Checking a trade Listed here’s what you need to know to observe your positions and adjust them as essential.

Step one should be to define what you would like to achieve. Ensure your targets are unique, measurable, and realistic. This will let you stay targeted and determined.

Some traders may well use a mix of both equally strategies to achieve a far more detailed knowledge of the securities they're trading.

Compared with long-phrase investors, working day traders are fewer concerned with the fundamental value of the securities and a lot more focused on capturing speedy gains from market fluctuations.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! Robbie Rist Then & Now!

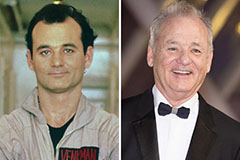

Robbie Rist Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now!